There is nothing quite as exciting as boating. However, purchasing a boat is a huge investment, and one you need to protect with Watercraft Insurance. While there are a number of considerations to make when purchasing this type of insurance, with a little bit of information, you will be able to make an educated purchase that will protect you and your watercraft. Learn more here.

Why do You Need Boating Insurance?

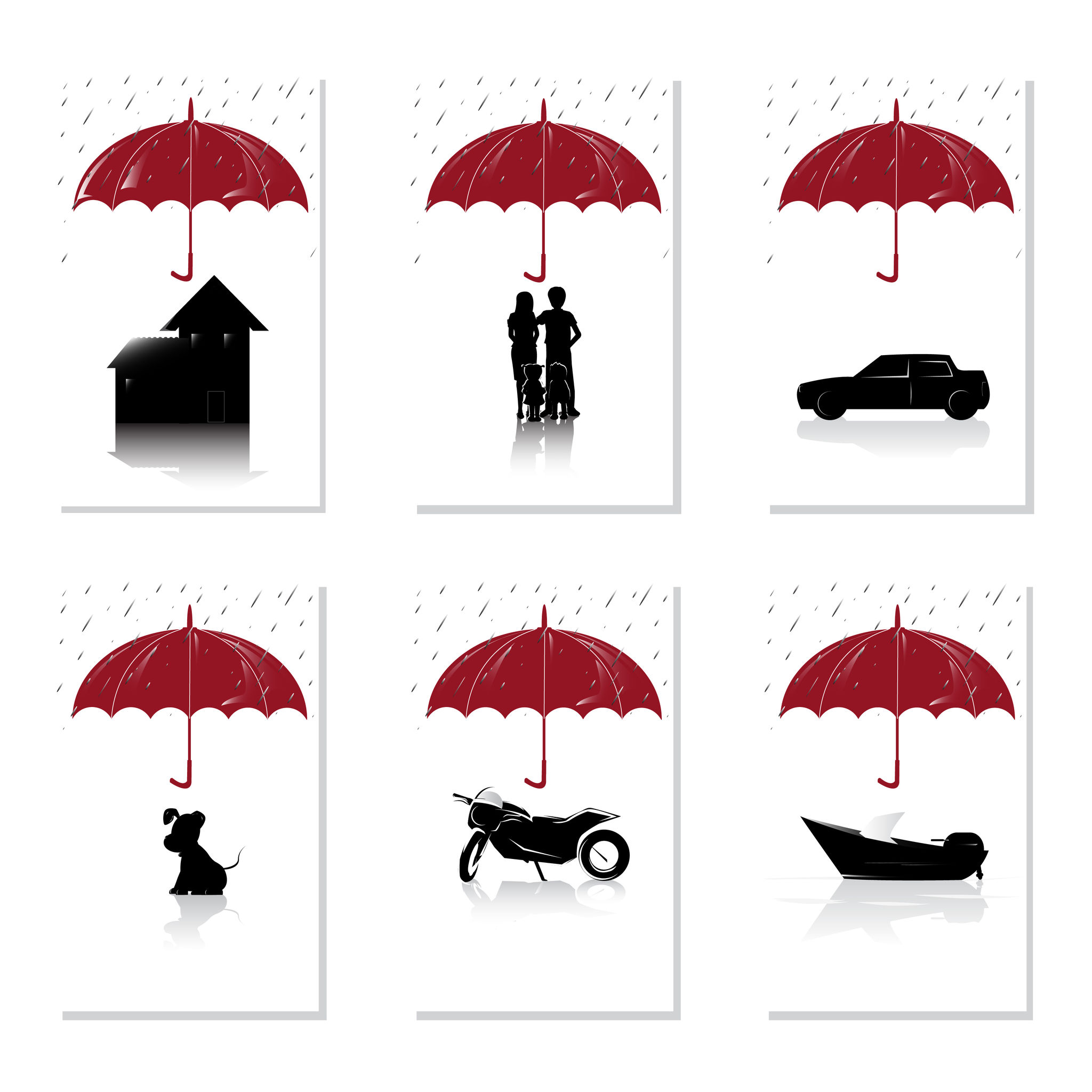

If you are new to the boating world, you may be under the impression the homeowners insurance you have will cover your boat. However, the fact is that, in most cases, this is just not the case. The boat that you have has absolutely nothing to do with your actual home. However, you can save money by bundling your Watercraft Insurance with your auto or home insurance.

How is Boat Insurance different from Auto or Home Insurance?

While these types of insurance are similar in some ways, boating insurance will protect your watercraft and is essentially a mash-up of your auto and your home insurance. Like your home insurance, a watercraft policy will cover the liability if a person is injured while they are on your craft and will provide you with the choice of having the boat replaced or the cash value if it is a total loss.

Like your auto insurance, the boat insurance that you purchase will usually cover any type of bodily injury or property damage. You will also be able to purchase a policy offering comprehensive coverage, for instances of flood or fire, vandalism or theft. You can even add on road side assistance in the instance that you need to have the boat towed somewhere.

When you understand the necessity of boating insurance, you will see why you need to purchase this policy. If you have more questions about coverage, contact Coast Auto Insurance Services Inc. Here you can find all the information you need regarding boating insurance and protecting your investment. This will ensure that your boat, and your person, are protected in any instance of damage or injury that occurs with your boat. Click here for more information.

Follow us on Twitter for latest updates.