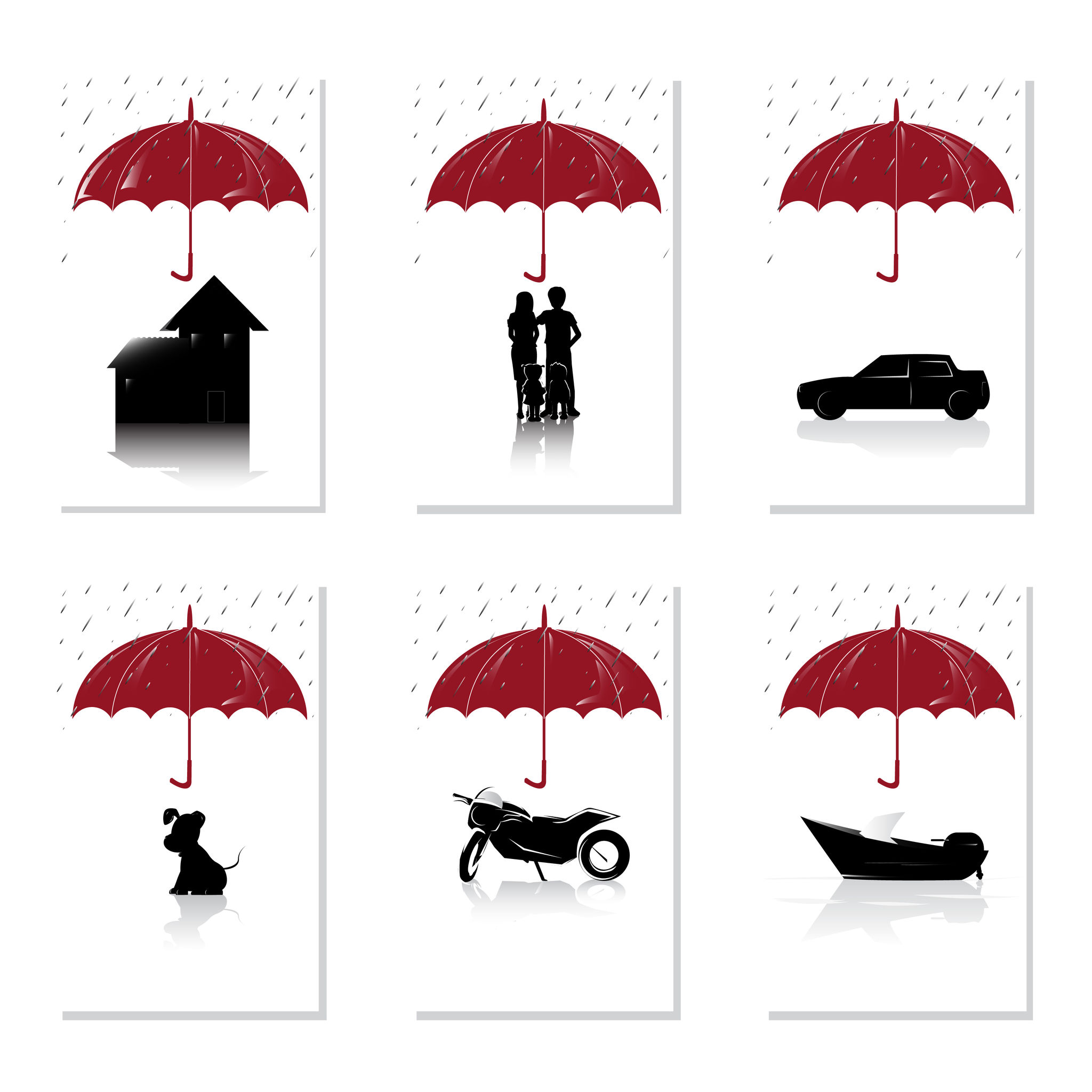

If you own your home it’s likely that your mortgage lenders will likely require you to have home insurance anyway, but if they don’t you may wonder if it would still be worth having it.

Imagine the worst happens and you have a fire in your home, or you have a break-in and some of your valuables are stolen or damaged, won’t it cost a fortune to replace them? Not if you have home insurance. Home insurance will cover the costs of the items you’ve lost and allow you to rebuild again so you can get back to your life as soon as possible.

What if my home suffers from subsidence?

Your home insurance policy will generally cover your building against damage caused to the structure of your property or outbuildings, allowing you to also do the work necessary to prevent further damage such as with underpinning, where your property’s foundations will be strengthened or deepened.

Will my insurance company cover me against acts of god?

In a word, no, but only because the term ‘act of god’ isn’t used anymore in Palm Desert CA, or anywhere else, for that matter, so act of god insurance is no longer a thing. Your home insurance should, however, cover natural disasters, such as flooding from storms, and lightning and any further issues that could cause, such as fire or electrical issues, or damage caused by high winds, like fallen trees or debris colliding with your house and other such matters.

Click here to buy Homeowners Insurance Cathedral City CA