In the United States, you are not allowed to drive your car on a public road without insurance. Therefore, you are forced into a marketplace if you want to drive a car; you don’t have a choice in the matter. In some areas, this has led to great competition, driving insurance prices downward. In other areas, it has actually reduced the amount of competition, because insurance companies know that everyone has to buy from them. Since the customers are a captive market, the company has very little incentive to lower its prices. The introduction of broad insurance companies has busted many of these trusts. If you are buying your cheap auto insurance from the same company that insures your home or business, you can save incredible amounts of money.

Saving Money

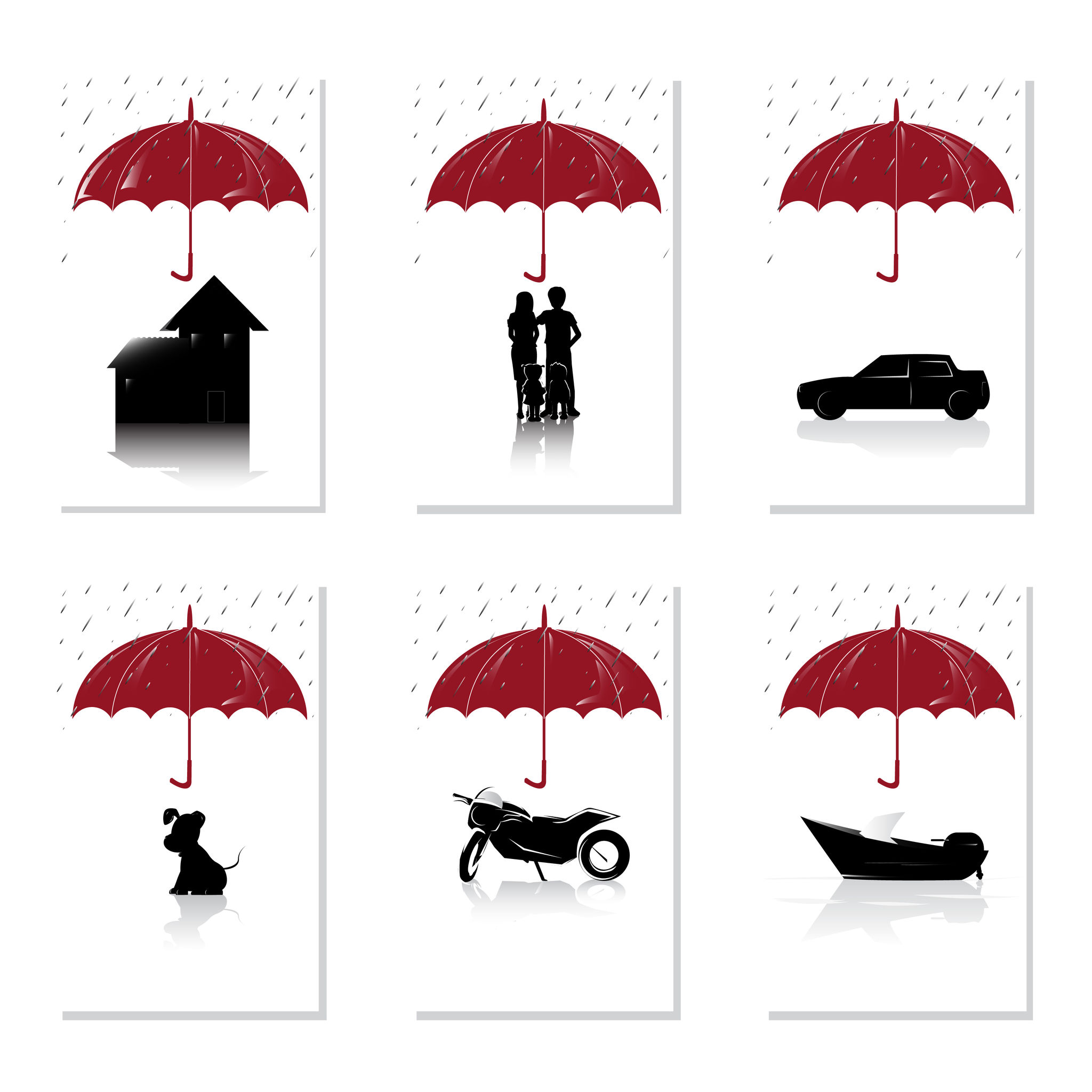

You can save money if you bundle your insurance services, or if you simply buy from a company that offers different types of insurance. If a company wants to offer cheap auto insurance in Tulsa, OK, it needs to have a diverse customer base. For example, if they are providing commercial insurance and home insurance as well, they can keep their profit margins for auto insurance very low. Since auto insurance is the most common kind of insurance, Tulsa cheap auto insurance can have small margins and a wide customer base. The profits come from other business products.

Finding the Right Company

So, you should find cheap auto insurance from a company with diverse product offerings. Also, you should look for a company that has been around for a long time. Heavy competition in the market tends to drive out overpriced or low-quality companies. If a company has managed to survive for a few years and even diversify their services, they are likely providing a quality service that a lot of people want to buy.