Most people don’t think about the cost of medical until they get sick. This kind of thinking can lead to thousands of dollars in unexpected treatment costs. The point of Health Insurance in St. Augustine is to reduce the overall cost of keeping policy beneficiaries in good health. By paying a monthly fee, and in most cases a co-pay, policy holders can afford to get the medical treatment they need without having to worry about the cost. When accidents happen, serious illnesses are diagnosed, or an expensive treatment is needed health insurance comes in. Rather than having to spend thousands of dollars on a treatment policy holders can make affordable payments to an insurance provider, making it easier and more affordable to get treatment right away.

Policy holders with a family will gain the most benefit from health insurance in St. Augustine. Children need medical treatment on a regular basis. Between immunizations, physicals, and treatments for illnesses children can be quite expensive to keep healthy, especially if the cost has to come out of pocket. Spouses and children can get the treatment they need from a policy with the right coverage. It will be important for the policy holder to find the right coverage. Speaking with a professional agent can help make things clearer. Understanding a policy is the best way to get the most out of it. More importantly, the policy holder should know the limits of their policy. Knowing when a treatment is going to be paid out of pocket will help minimize surprises in a doctor’s bill.

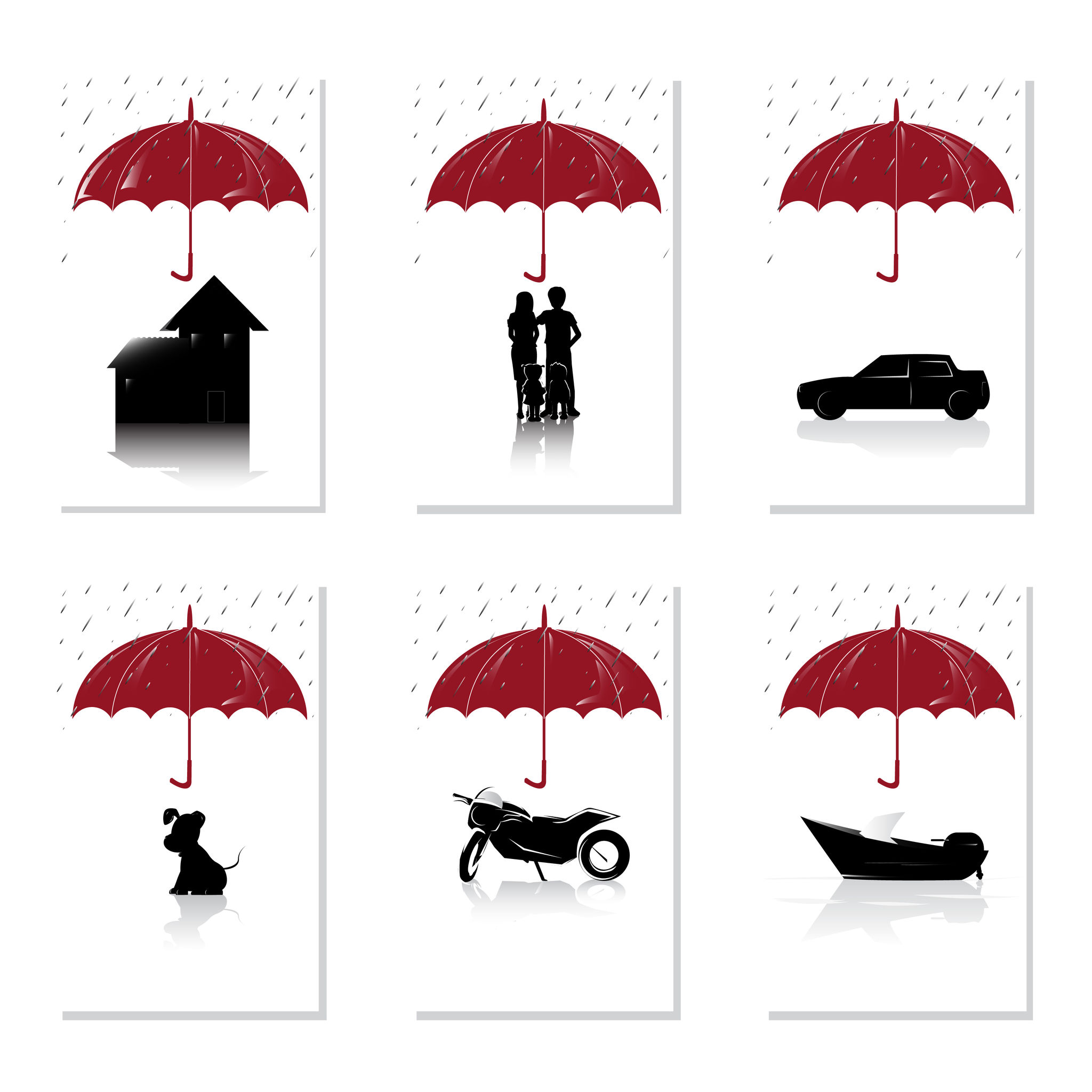

Many policy owners save money by bundling insurance policies. Many insurance providers that offer Health Insurance in St. Augustine also offer Homeowner’s insurance. By bundling insurance policies the holder could save hundreds of dollars per year. The cost of the health insurance policy will depend on several things. The overall health of the policy holder may impact the cost of coverage. The number of beneficiaries and their overall health my impact cost as well. As with any insurance policy the amount of coverage and the deductible will impact the price of coverage more than anything else.